Cognitive biases to be aware of

"The Art of Thinking Clearly" illustrated - Part 4

Another week, another occasion to be reminded how bad we are at that daily task called “Thinking”.

If you have been following this serie, you know the drill, we are going through the book “The Art of Thinking Clearly” by Rolf Dobelli, illustrating each of the cognitive biases presented.

To find the previous illustrations:

Make sure also to be subscribed to avoid missing any of the future posts.

Loss Aversion

We tend to be more driven by the fear of losing something than by the opportunity to gain something of the same worth.

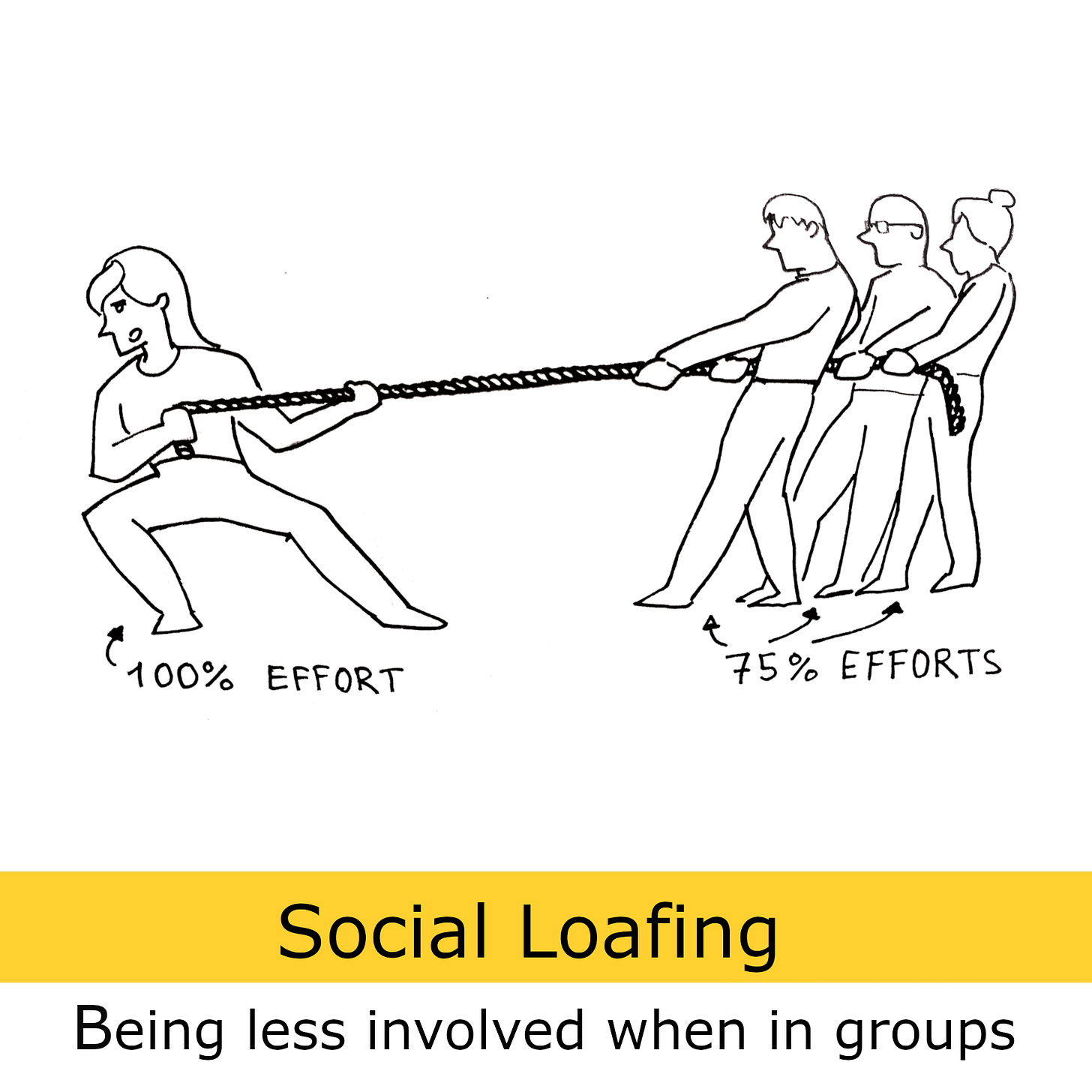

Social Loafing

When we work in a group, we tend to not put in as much effort as we would if we were working alone.

This happens less in teams that are diverse and with different specialized talents, in that case the individual performance is more visible, reducing the Social Loafing.

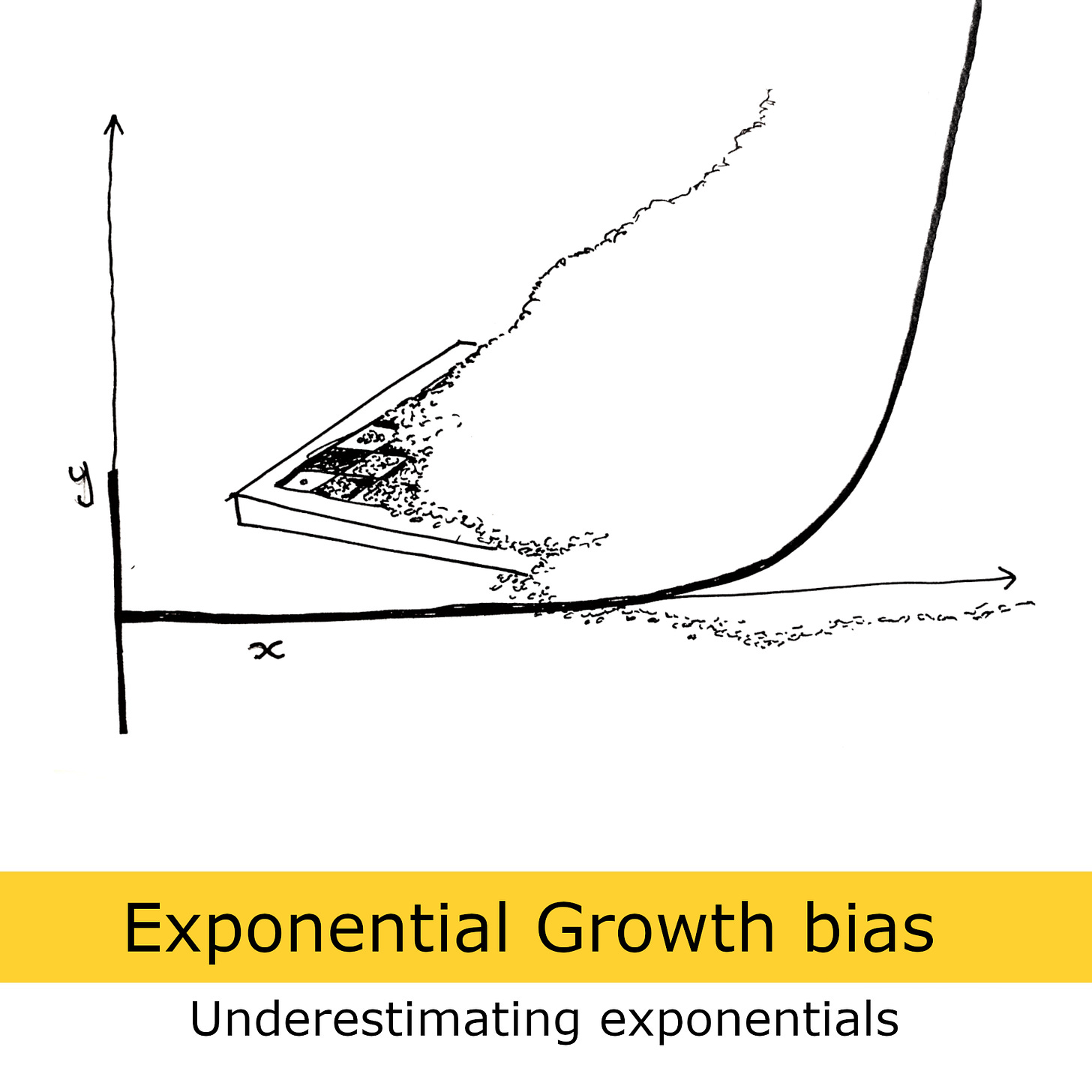

Exponential Growth

We often struggle to intuitively understand exponential growth, as exemplified by the famous story of the rice and chessboard. In the story, a king agrees to give a wise man rice by doubling the amount on each square of a chessboard. While this seems manageable at first, the rice quickly accumulates to an astronomical amount (would have needed over 18 quintillions rice grains…), highlighting the challenge of comprehending exponential growth compared to linear growth.

Winner’s Curse

The Winner's Curse occurs in bidding situations, such as an auction. Often, the winning bid is higher than the true value of the item, usually because the winner overestimates its worth or desires to win the auction at any cost.

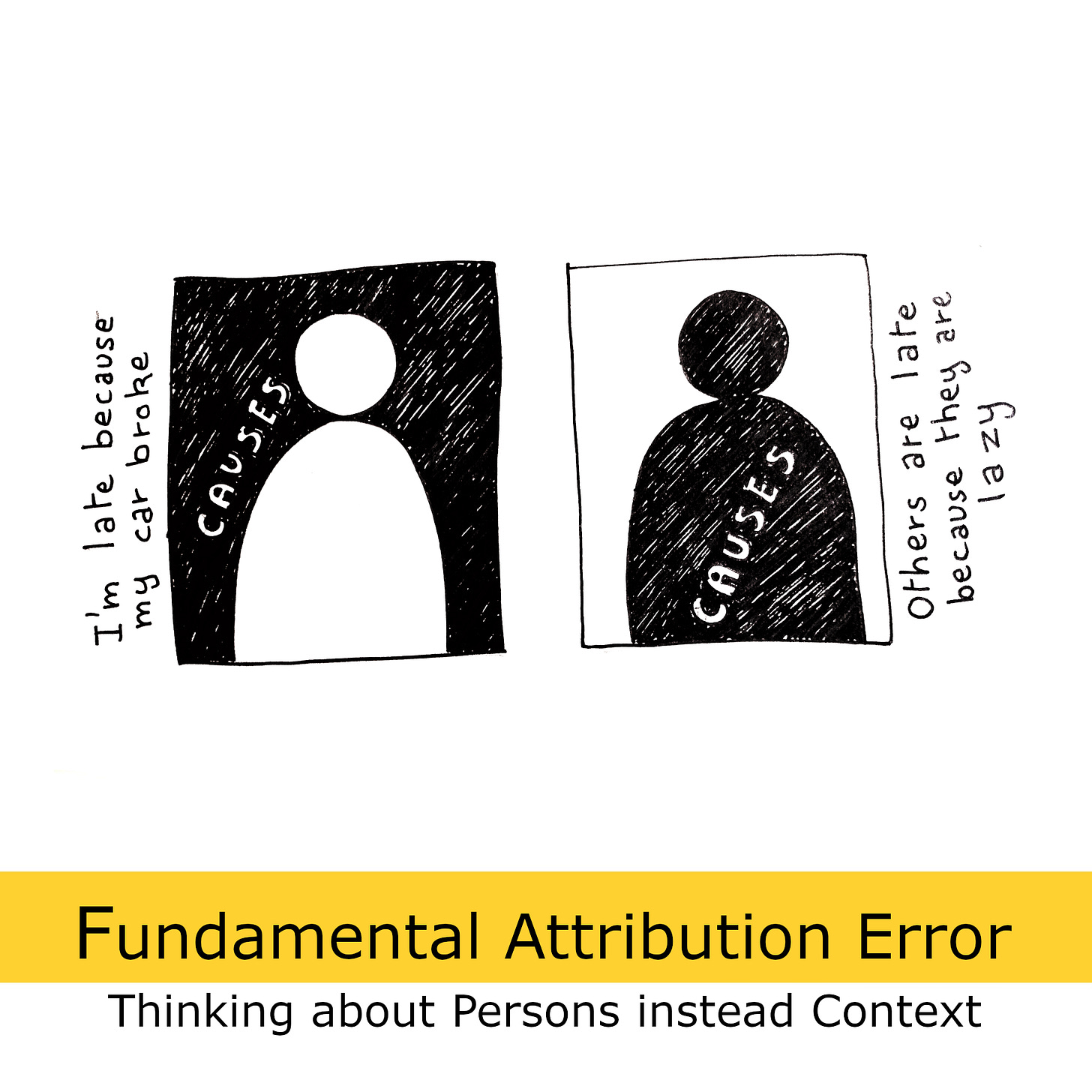

Fundamental Attribution Error

People often have a tendency to overestimate the impact of individuals while underestimating external situational factors.

We are usually very good at avoiding this bias when thinking about our shortcomings, but very bad when it comes to applying the same to others or to historical or current events. (Example: Thinking the success of a company being due to one charismatic leader.)

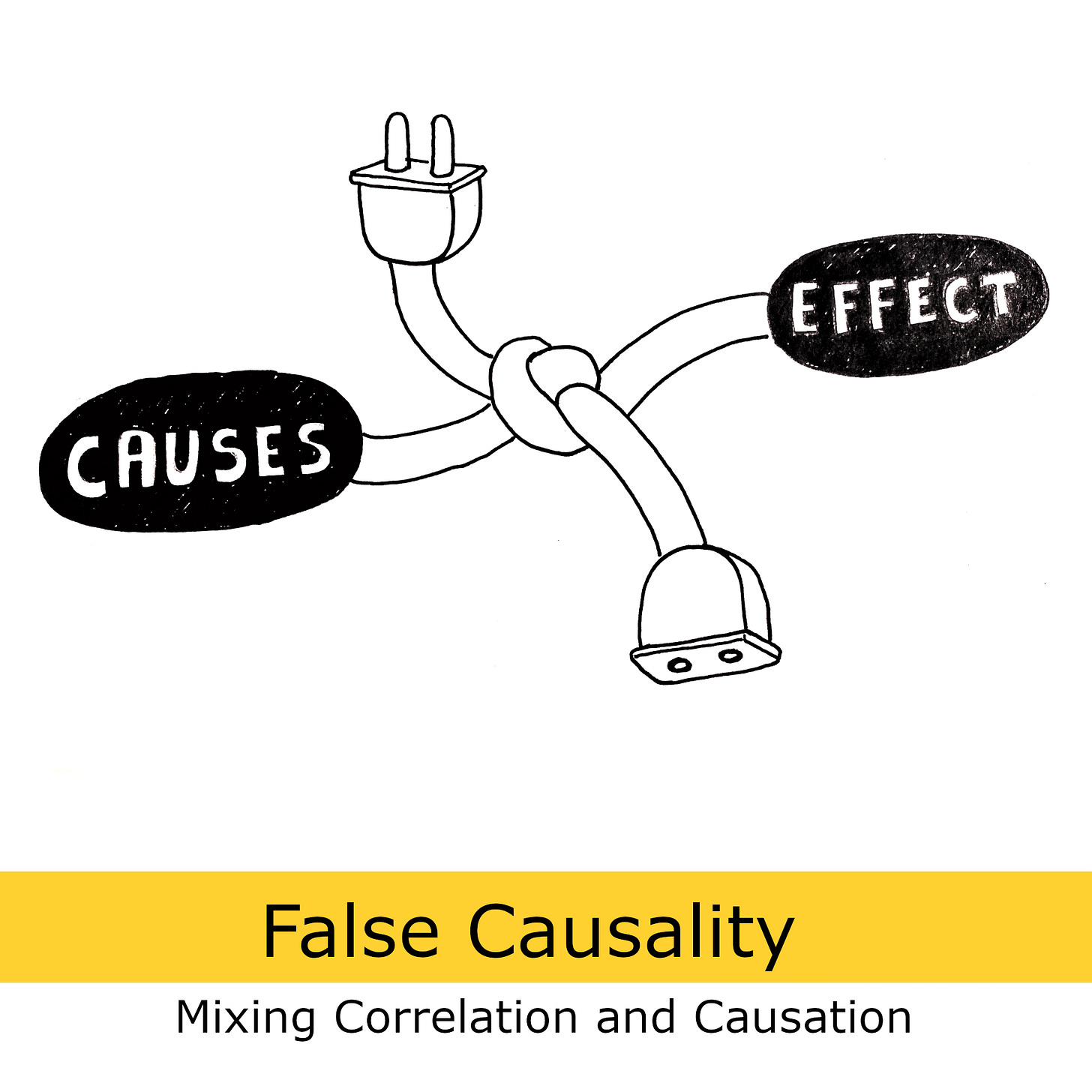

False Causality

False causality occurs when a relationship is assumed between two events or variables, but there is no direct evidence to support that one causes the other. It's a mistaken belief that one thing is the cause of another when they may only be correlated or unrelated altogether.

Example: Ice creams sales increases correlates with Shark Attacks but are not caused by them :).

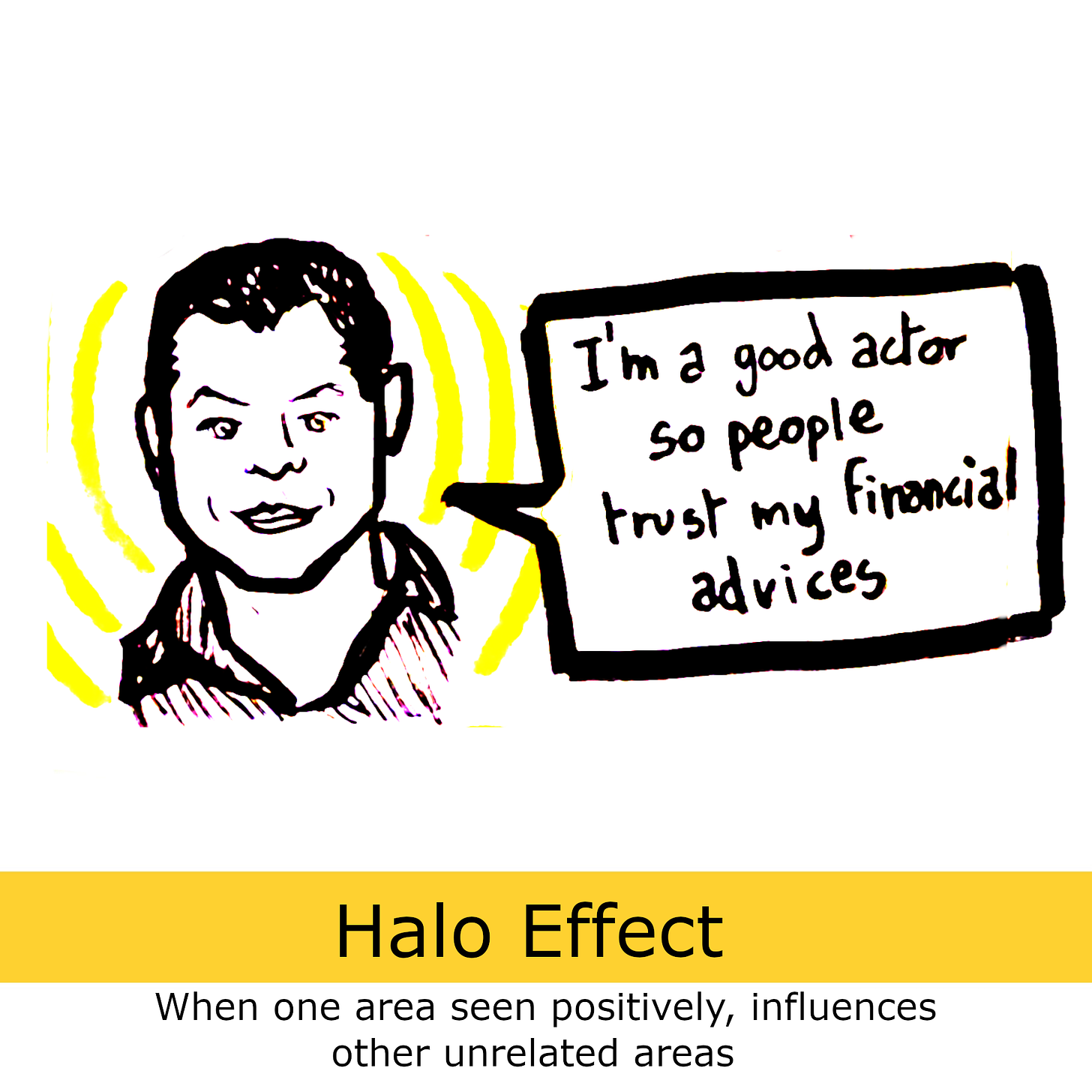

Halo Effect

The Halo effect is when our impression of someone or something in one aspect influences our judgment of them in other unrelated areas. For example, if we find someone physically attractive, we might also assume they are intelligent or kind, even if we have no evidence for those traits. It's a tendency to let one positive or negative quality overshadow our overall perception.

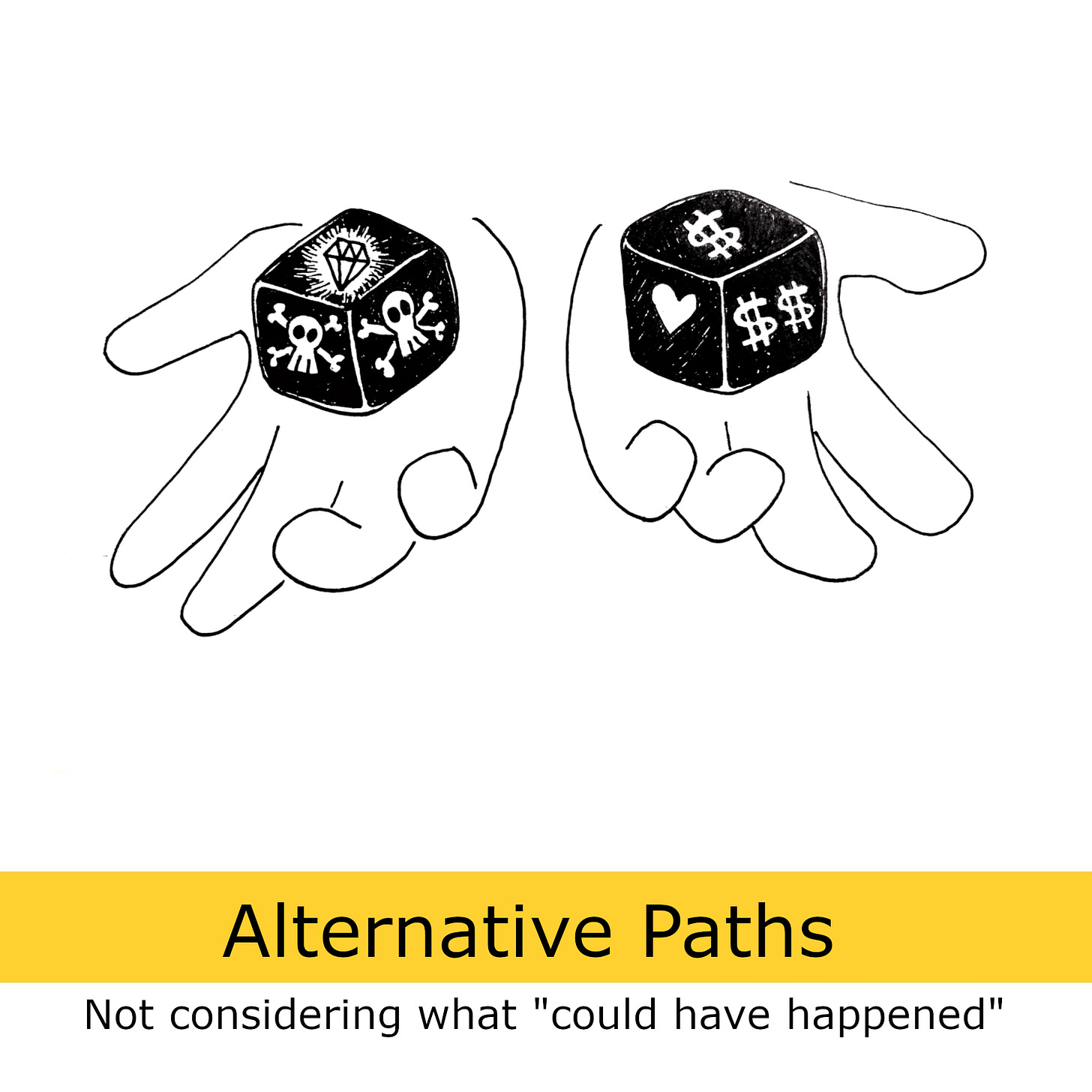

Alternative Paths

We often overlook all possible outcomes, leading us to underestimate the level of risk involved.

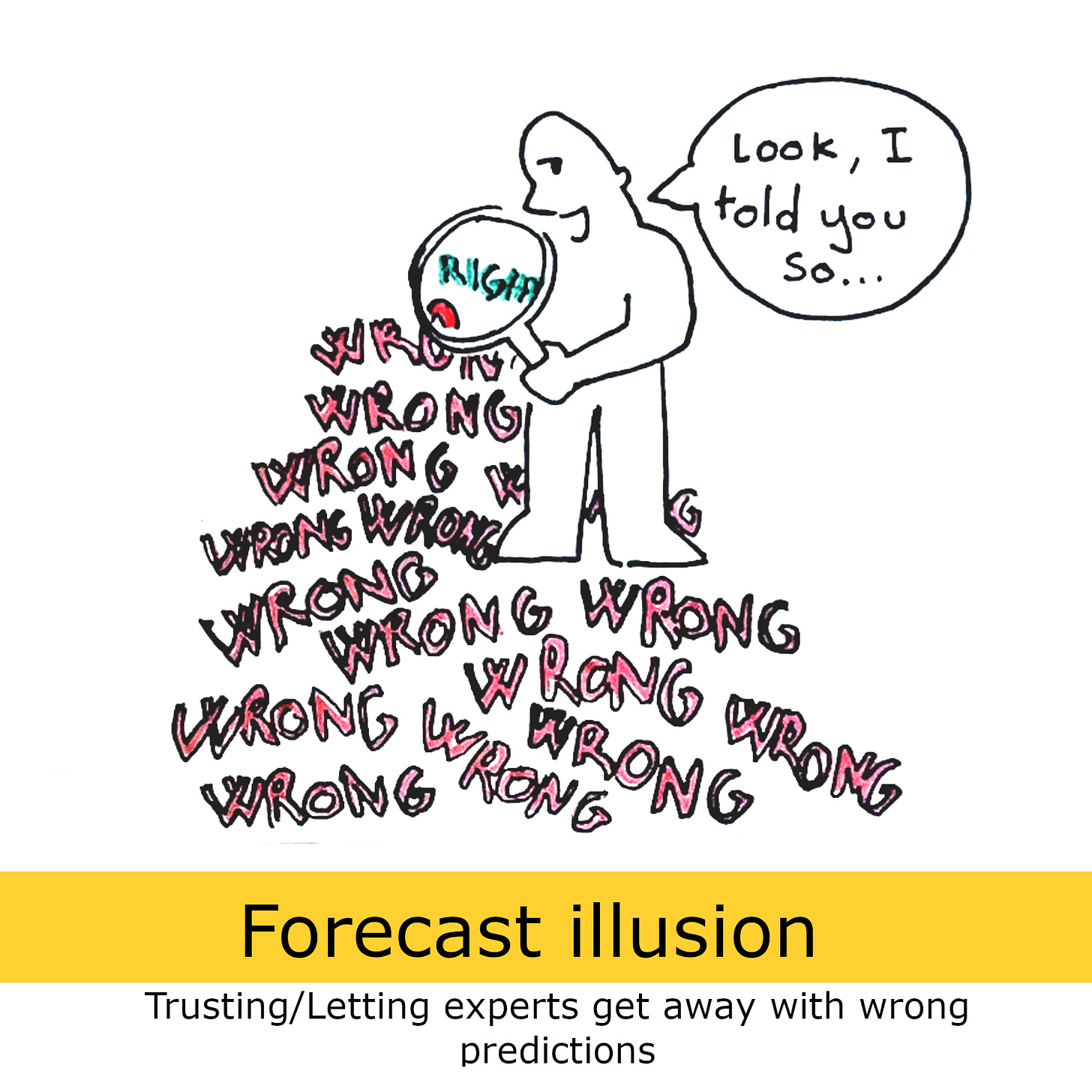

Forecast illusion

We often trust forecasts, even though they have a low reliability and carry minimal consequences to the “Predictors” for being incorrect.

That's it for this week, if you enjoyed it let me know in the comments.

Do you have a favorite drawing? Or the one bias you see most often around you.

I also appreciate when you share it with the people that may find it interesting, that encourages me to continue, and contribute to make more people experience the benefits of “Visual Thinking”.

You can now find the next drawings here:

Why Your Thinking is Still Biased

50 Drawings Completed! After a short break were I shared some tips about “System Thinking”, (find them in the button below👇) we are back with our exploration of our human Cognitive Biases. This is Part 5 of the visual summary for the book 📖 'The Art of Thinking Clearly

You may recognize some of the drawings from the illustration of "Antifragile". This is on purpose, as the book "The Art of Thinking Clearly" acknowledge the influence of Nassim Taleb's works, and some of the ideas are basically direct quotes from his books.

You can find the illustrations here:

https://open.substack.com/pub/ludtoussaint/p/antifragile-in-60-drawings-final?utm_source=share&utm_medium=android&r=1bc09s

Excellent Lud, thank you. Your image for Social Loafing makes the statement very clear and helps people look at the root cause. Bravo!