Antifragile in 60 drawings - Part 2

The Visual Summary of Nassim Taleb's revolutionary book continues!

We are continuing our visual journey through the book Antifragile.

If you haven’t read the first part, you can find it here:

I have realized that I have actually more than the expected 60 drawings to share… To keep it easy to read, I have split the post once more, so you can expect one final one after this! (next week).

Enough introduction let’s dive into the book.

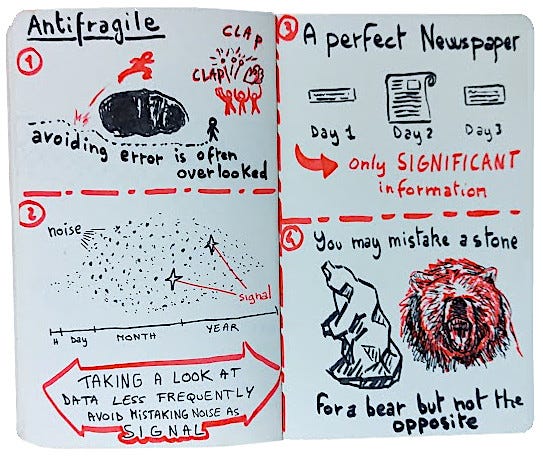

Noise and Signal

We finished last time with the concept of “naive intervention”, meaning acting when it is not needed.

A related issue is that, we are having access to more and more data, but most of it is noise, the more we look at it, the more likely we are to see noise as useful actionable data (signal) and take wrong decisions,

We can instead "procrastinate", wait and see, reduce the frequency at which we look at data, and only take action when there is significant changes in the data. Signal will not be mistaken as noise, in the same way than a live bear is not mistaken for a stone

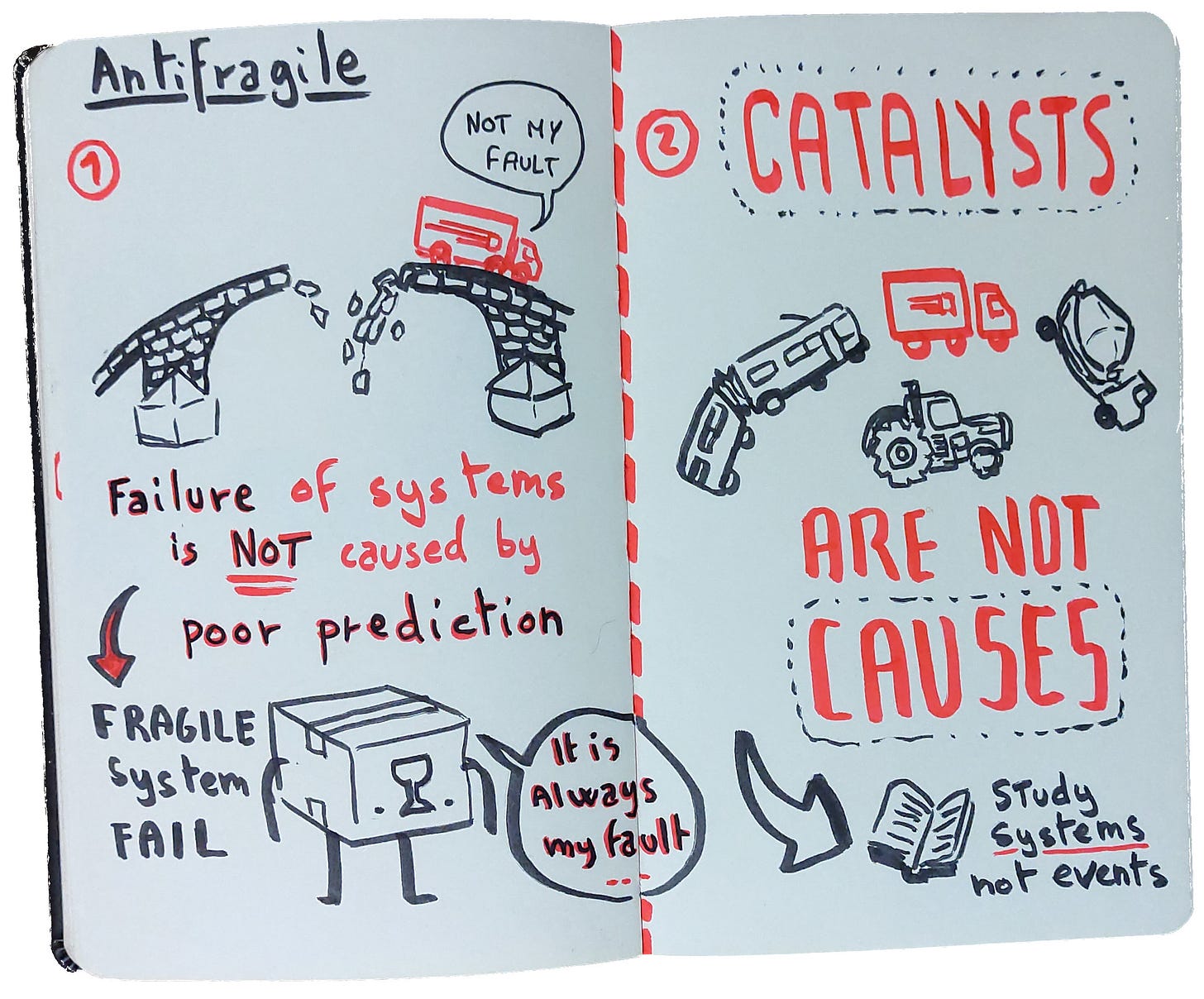

Catalysts are not causes!

When a bridge collapses, we can’t blame the last truck that happened to pass.

Any fragile system will eventually fail, thinking that we just poorly predicted is looking at the wrong problem.

We have to look at the fragility of a system not the events.

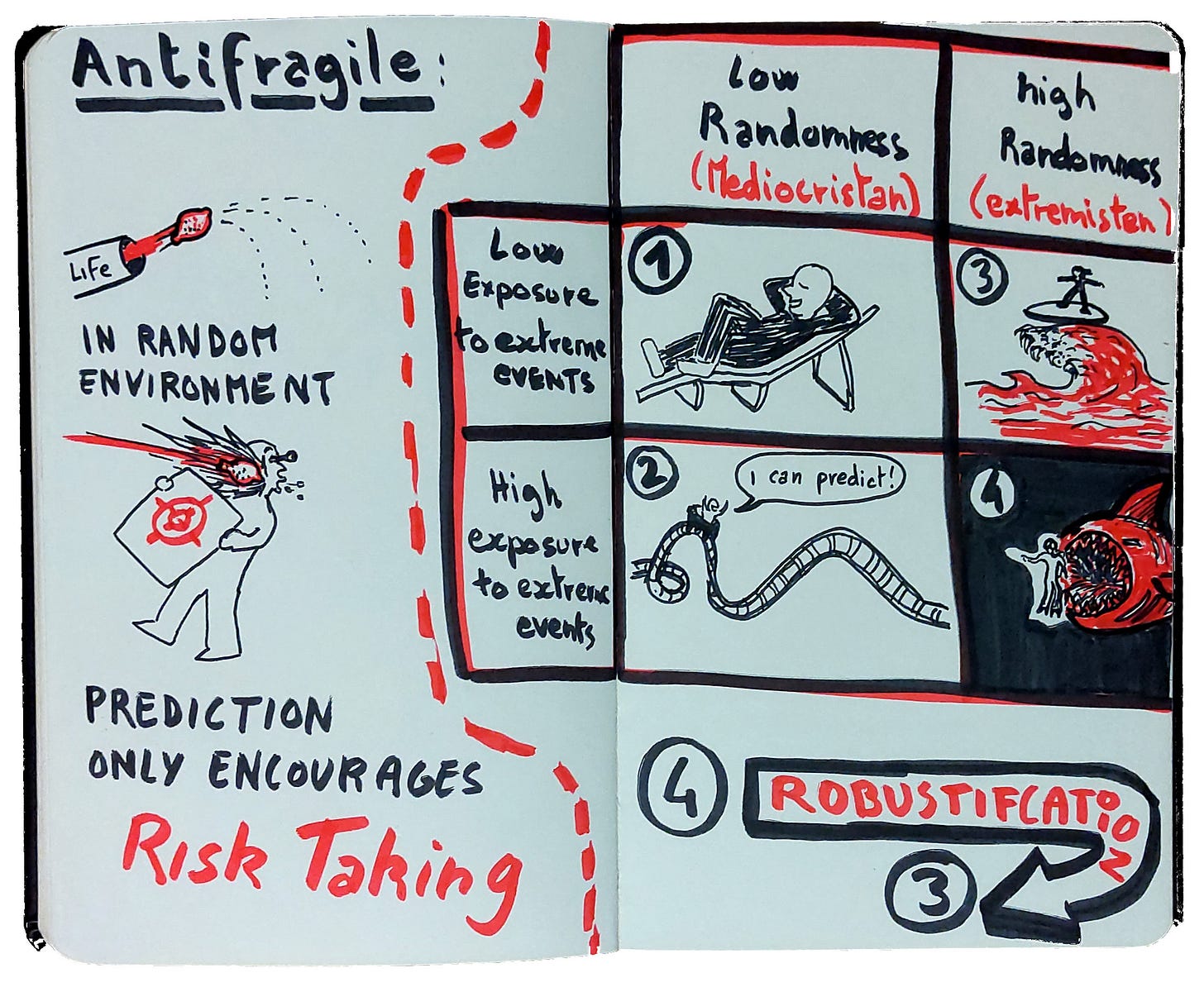

Mediocristan vs Extremistan

An environment can be either:

Low randomness (Mediocristan): Think human height, weight, anything where an outlier (example the heaviest person that ever lived) is still relatively close to the median.

High randomness (Extremistan): Is where prediction become useless, things can scale infinitely, unexpected event can happen, extremes can be so far from the median than a Gaussian distribution (bell curve) is not applicable (example: Jeff Bezos making in 1 min more than 3x the yearly salary of the median US worker.)

"Robustification" (becoming more robust/antifragile) is not about forecasting or trying to predict, but about reducing our exposure to extreme events (negative consequences).

In an extremistan world liek ours, we need to learn to move from the 4th quadrant, to the 3rd. This means finding ways to benefit, or at least being immune to forecasting errors, and being able to withstand the test of time and the likelihood of extreme events.

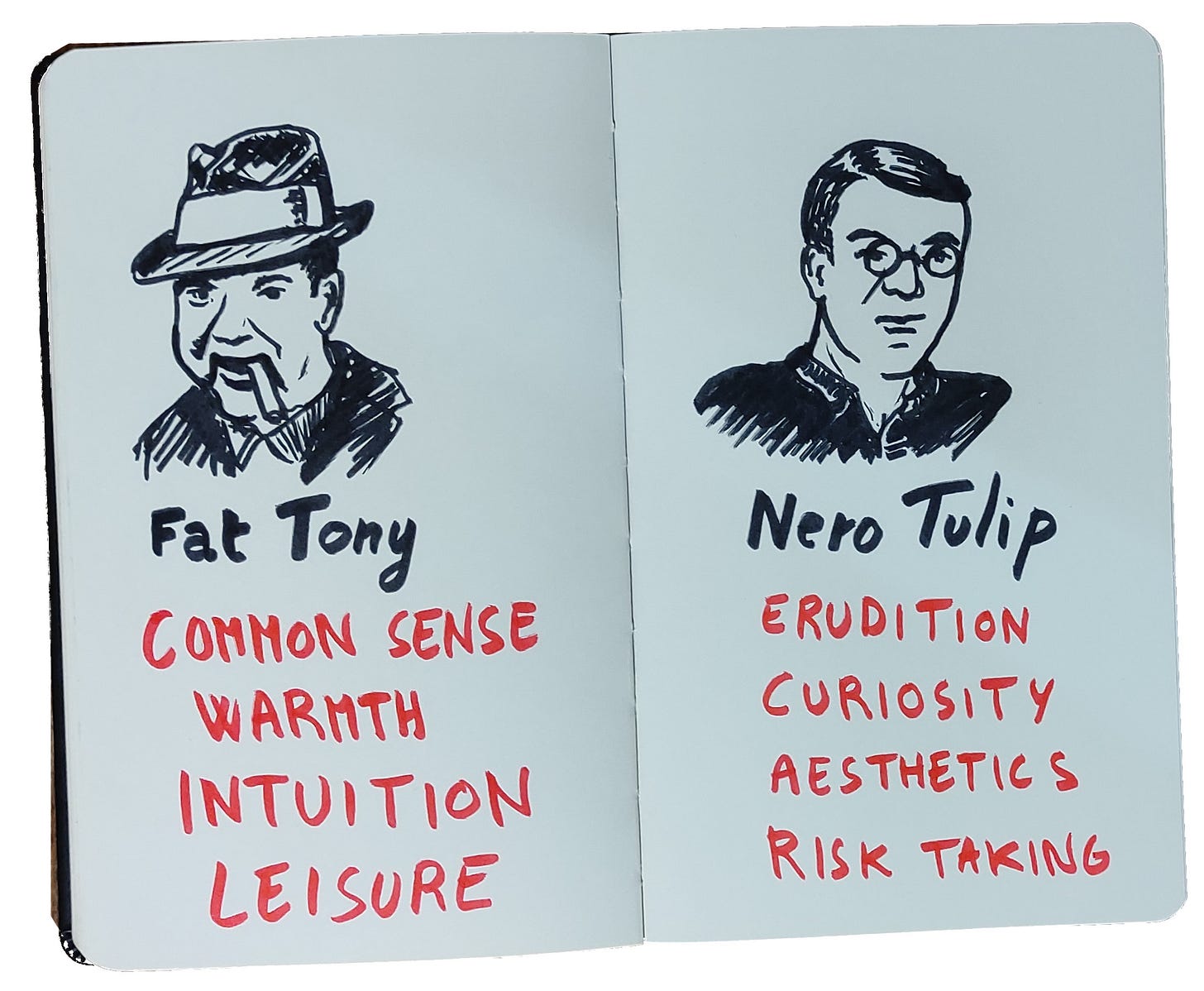

In this chapter, we are presented with two opposite characters, that were both able to understand a incoming crisis due to Fragility (the 2008 financial crisis).

How? Using each their own approachs, but both betting against the Fragility to prediction error.

However Fat Tony also put money on the line and won big.

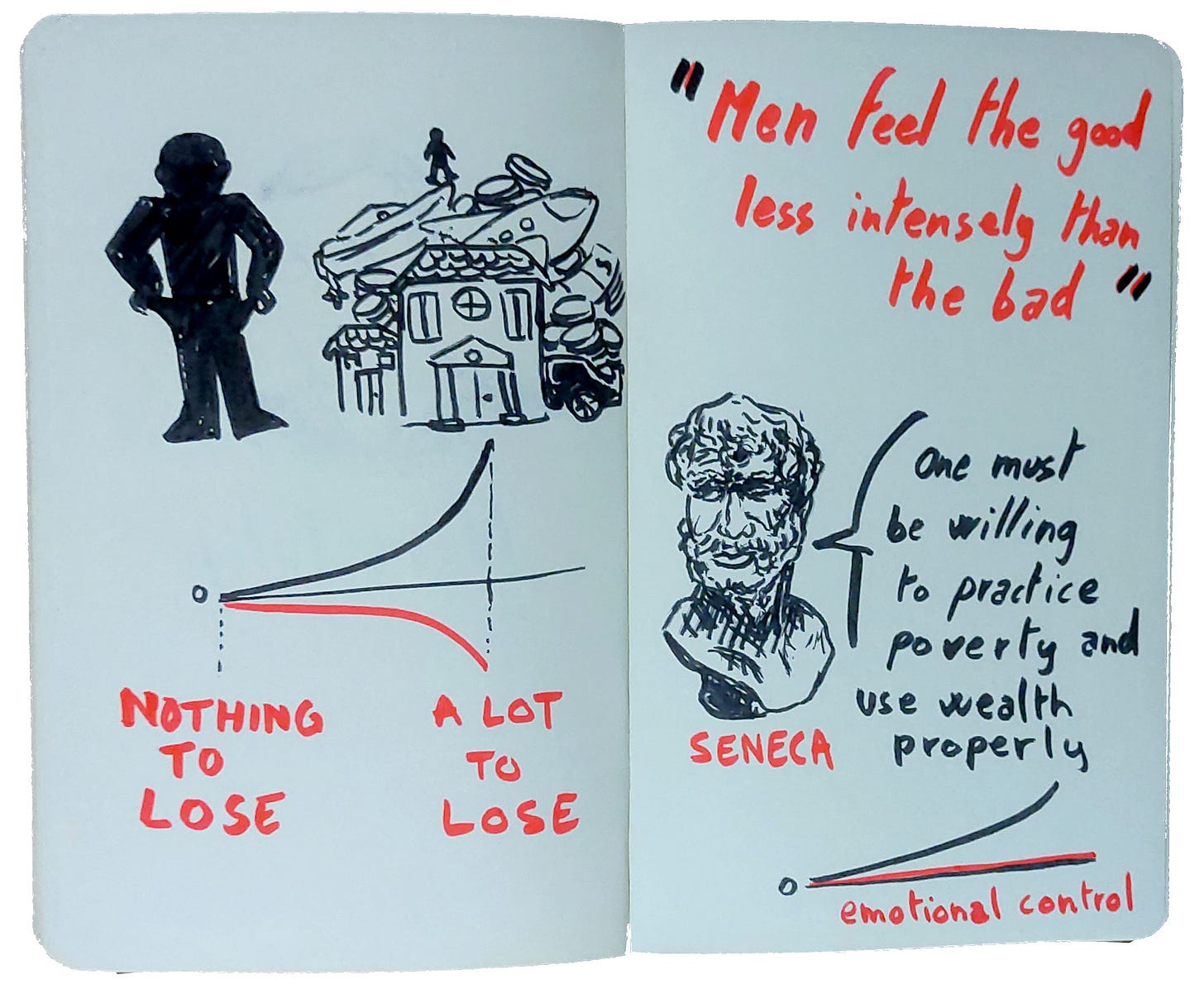

Lesson from the Stoics

Emotional robustness as shown in stoicism.

Being used to mentally write off your wealth (or upside) make you more robust to random events.

You will be less mentally affected by an unexpected lost, and more likely to have had taken measures upfront to avoid being in a dire situation when a lost happens.

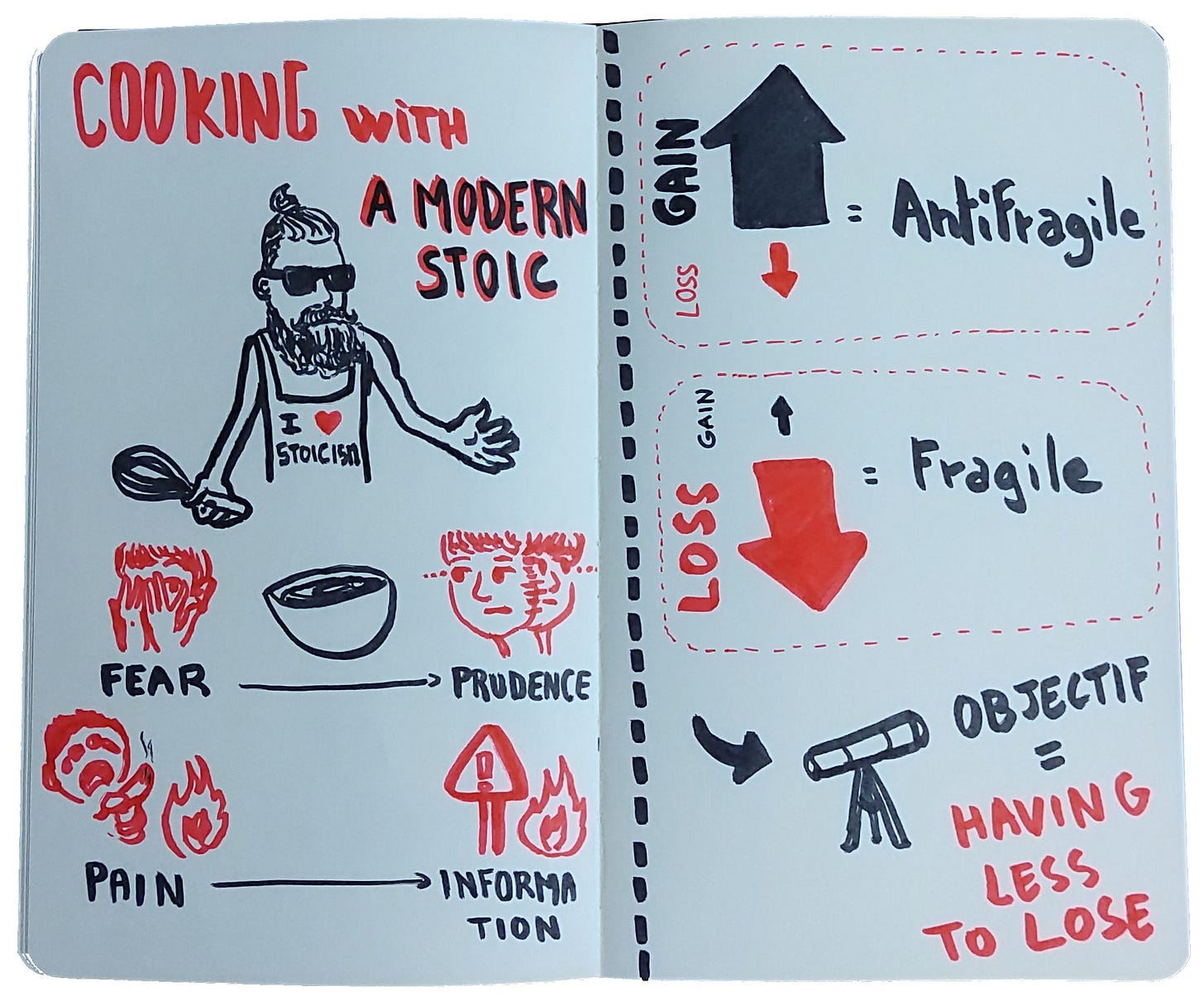

Being a modern stoic,

Turning fear into prudence, and pain into information.

Having less to lose, make us more Antifragile.

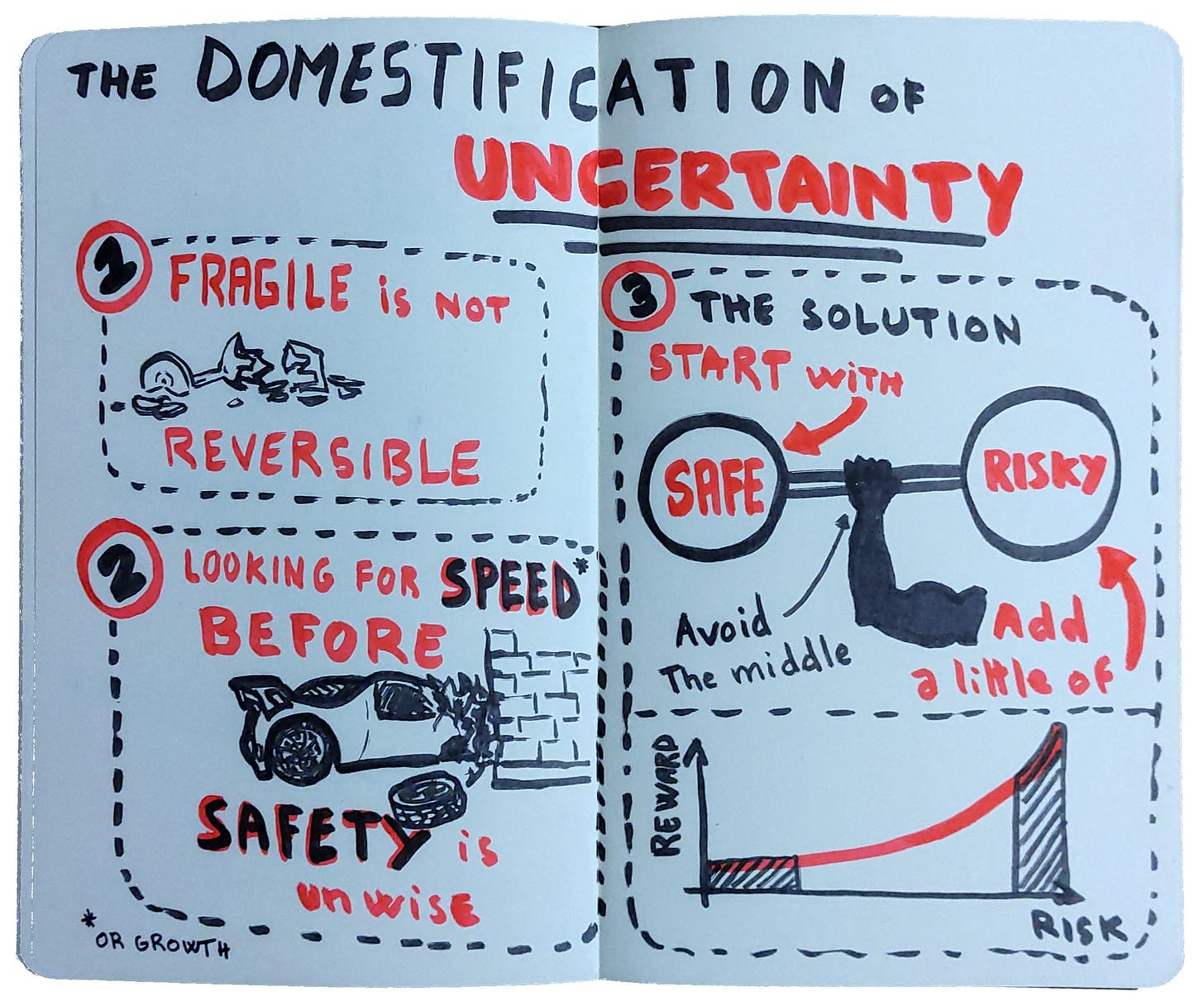

The Barbel strategy (or bimodal strategy) in investments.

Looking for growth without safety is unwise,

To maximize the upside and minimize the downside, you should:

Start with an extremely low risk, stable foundation

and only then,

Add a little bit of extremely risky but extremely rewarding to balance it.

If it doesn't work you loose a little, but are still ok, if it does work you gain a lot!

Avoid the middle where there is a potential for crushing loss.

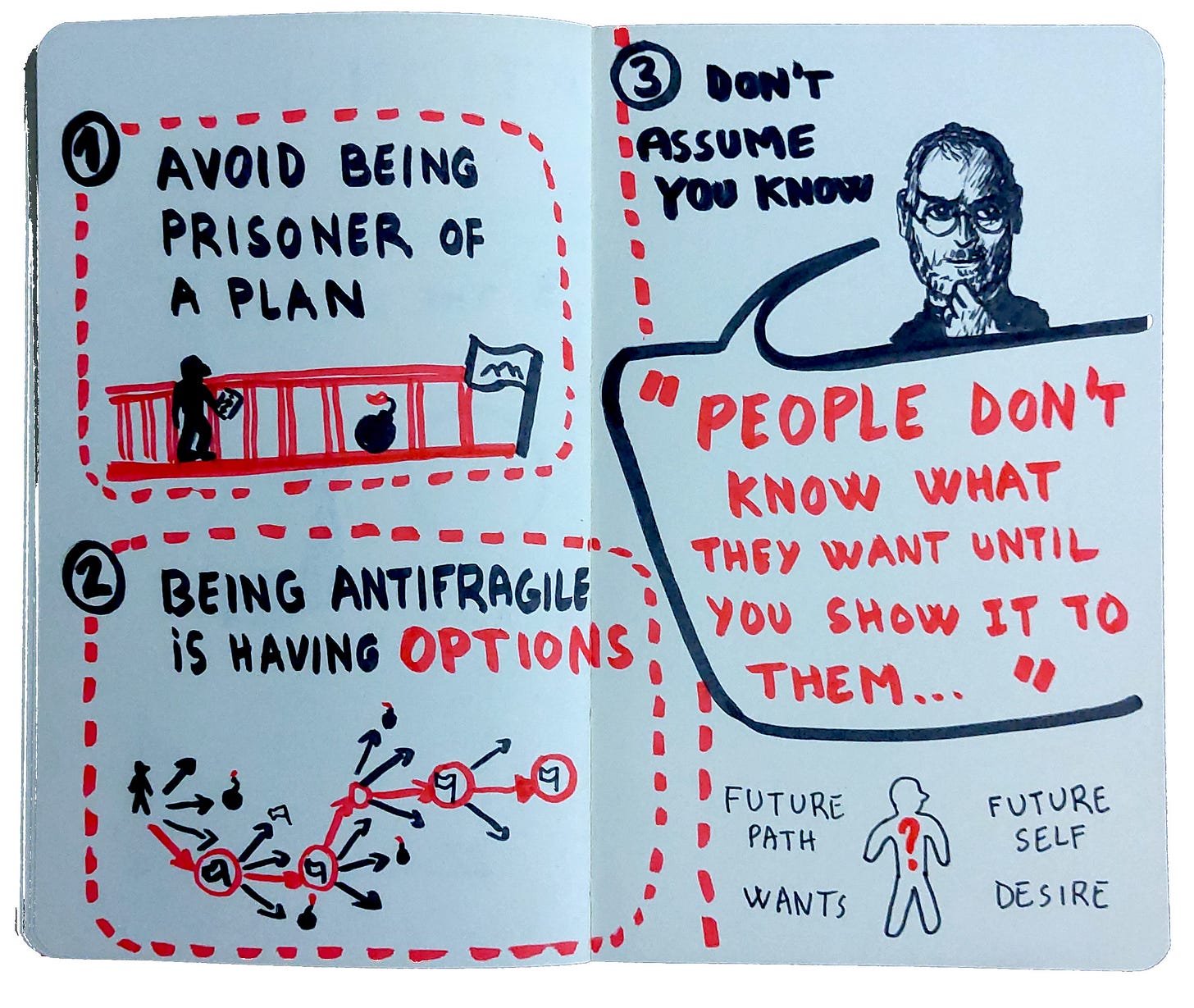

Optionality & Asymmetry

The Teleological fallacy:

Teleology= Telos (the end / goal), Logia (the explanation/ reason)

The Teleological fallacy is the illusion of knowing what the future will be,

…or thinking that people that were successful, did so by knowing where they were going.

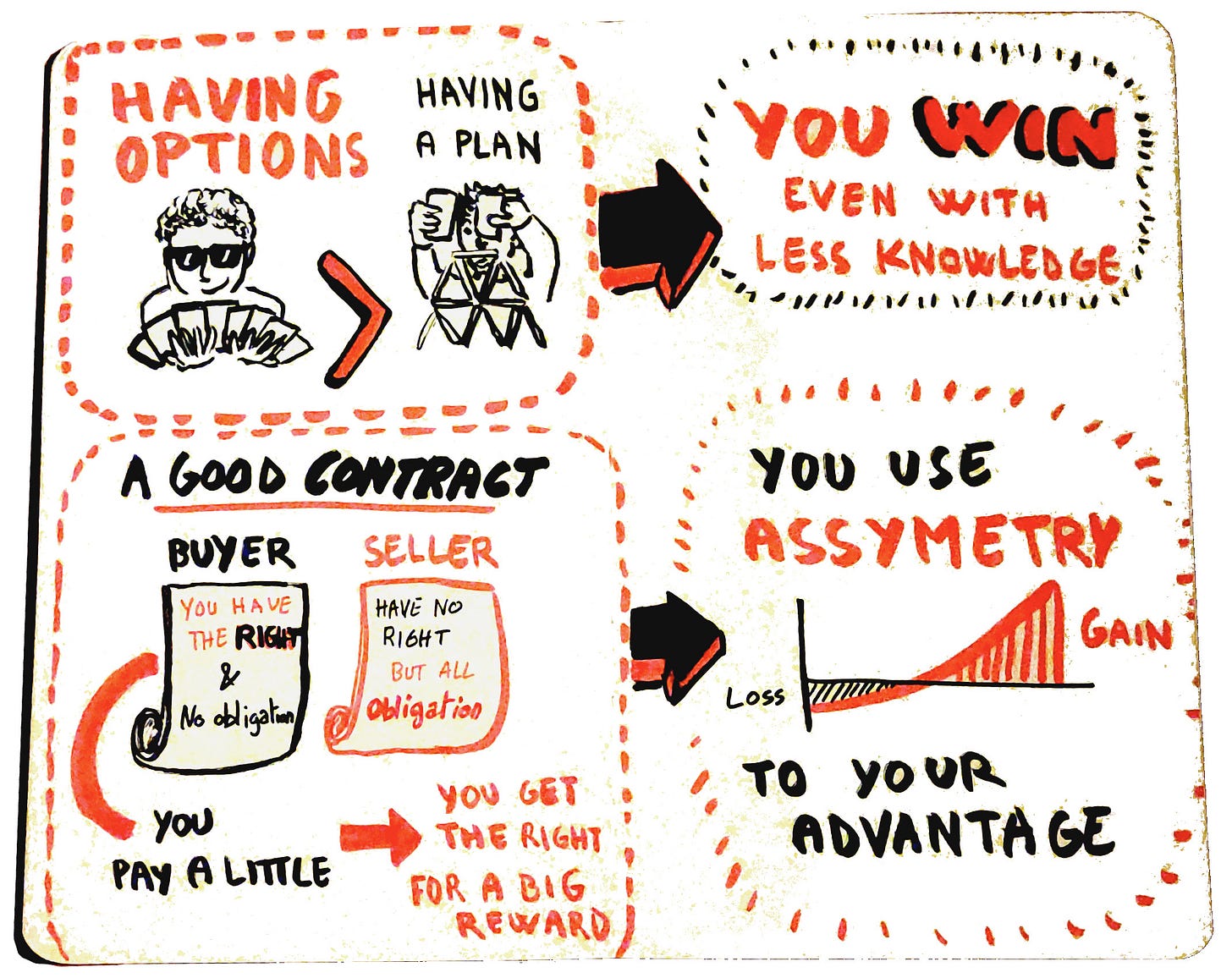

Having options is how we get antifragile:

You are not prisoner of a plan. You may course correct and change path as the situations or your desires evolves.

You use Asymmetry to your advantage (ex: pay a little but get the right to a big reward)

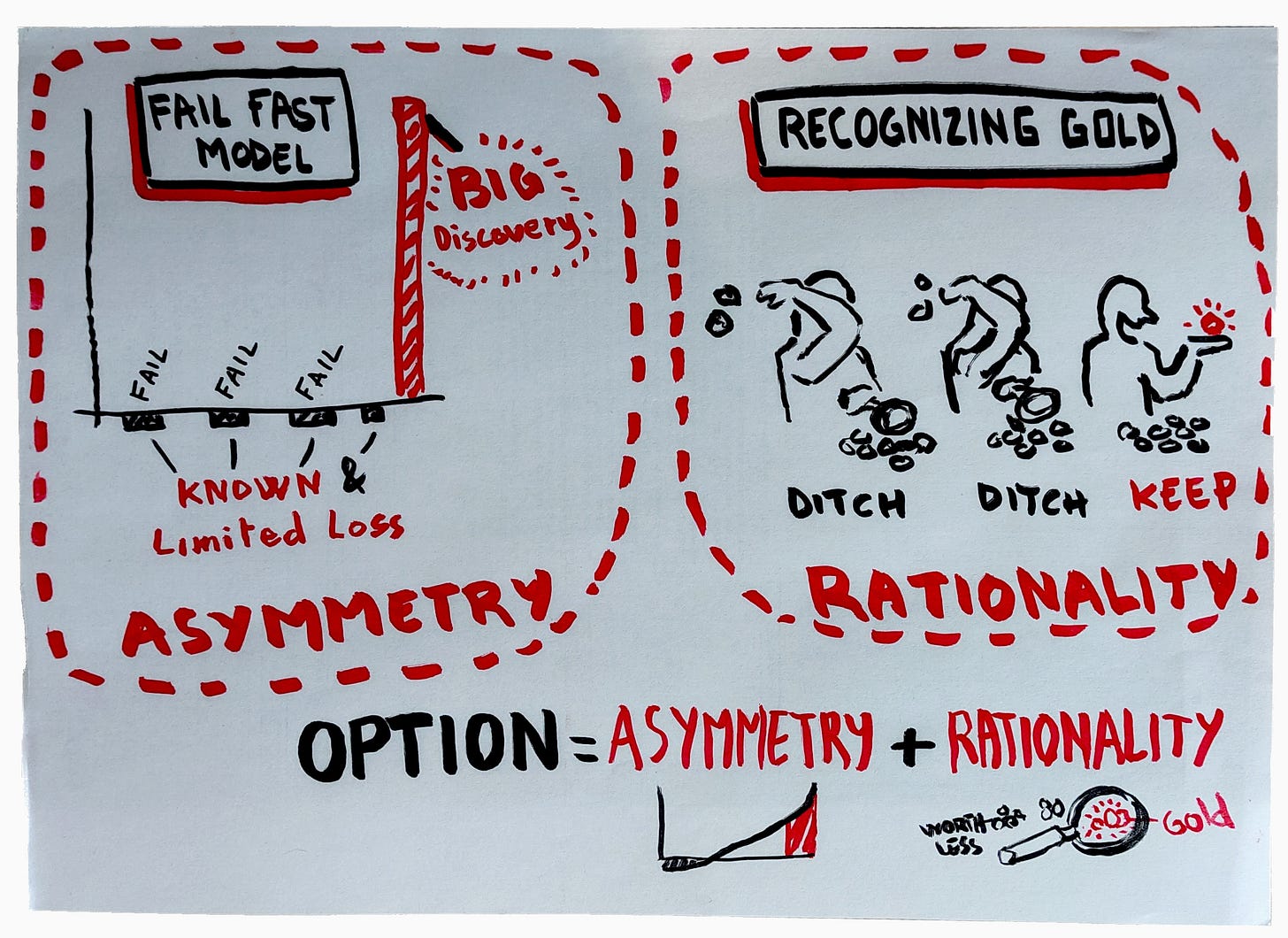

Optionality is having both:

Asymmetry (low - fixed loss, usually even free, but big potential reward)

Rationality (the ability to recognize the good, pick only the good reward)

Example of everyday Option:

A rent controlled appartment allows you to move easily if you would like to relocate, doesn't harm you if prices around go up, but allow you to move if prices around are getting cheaper.

A party where you are invited but not expected, you can go there if nothing better comes up.🙂

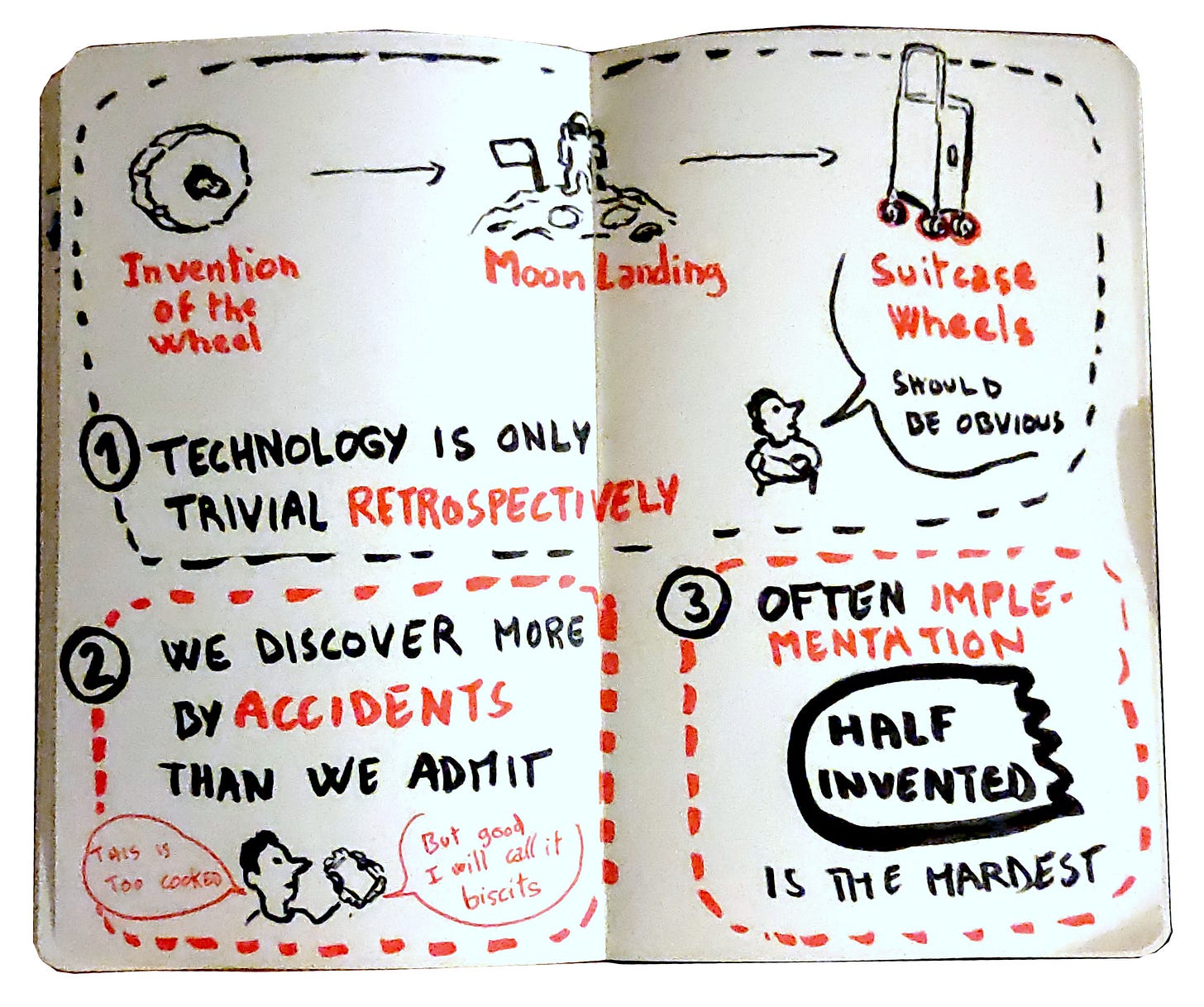

Tinkering and discovery

Did you know that we landed on the moon before we invented the suitcase wheels? Or that Greeks had a kind of steam engine?

Nassim Taleb uses those examples to reflect about the dissociation between invention and implementation / application.

Implementation is usually the result of random tinkering and chance.

Lots of things must be still “half-invented” just waiting for someone to find their application.

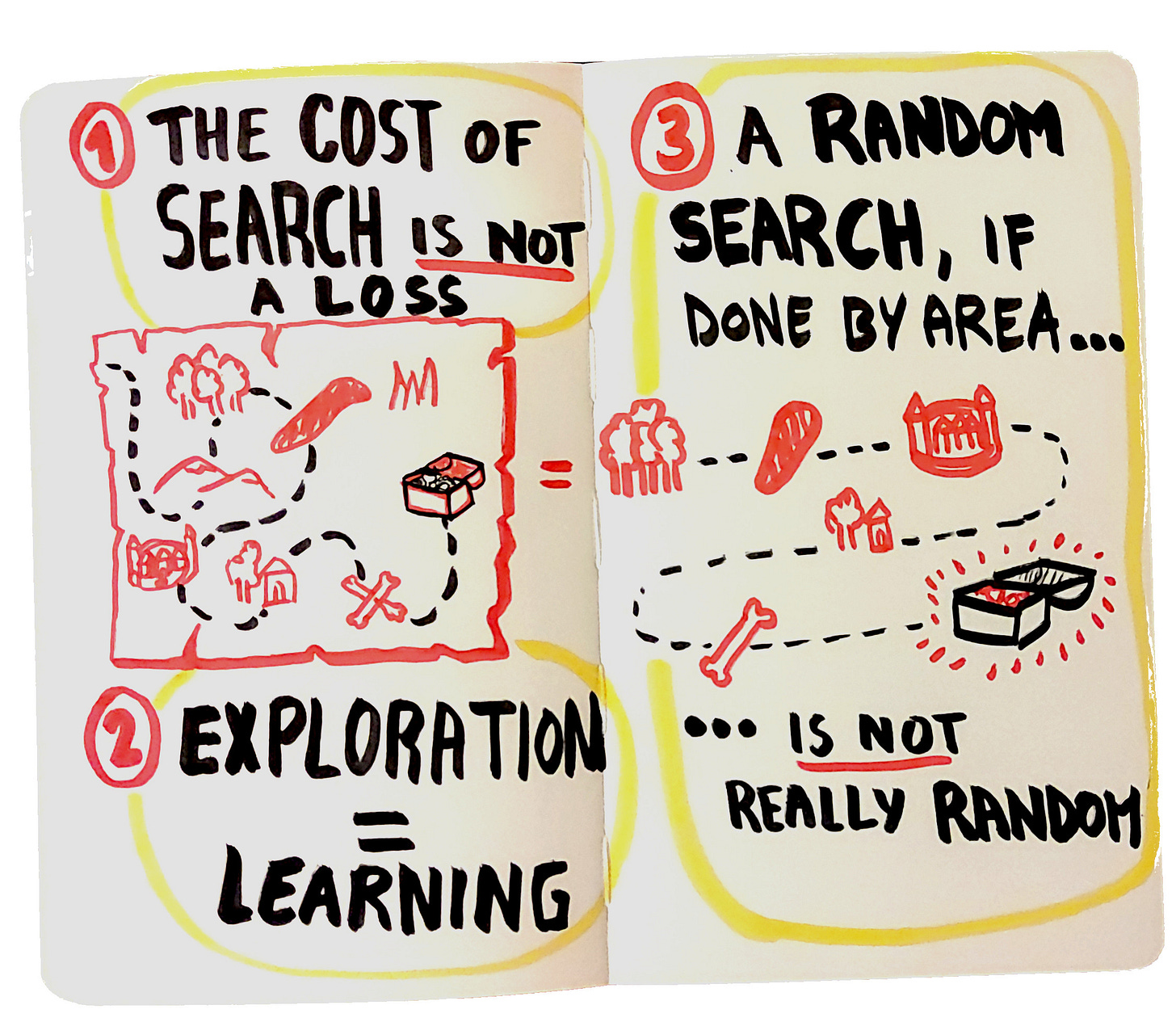

The value of Exploration = Learning.

What seems like a random search may not be so!

Define the areas

Start with the highest probability of discovery

Meticulously go through each areas.

Profit!

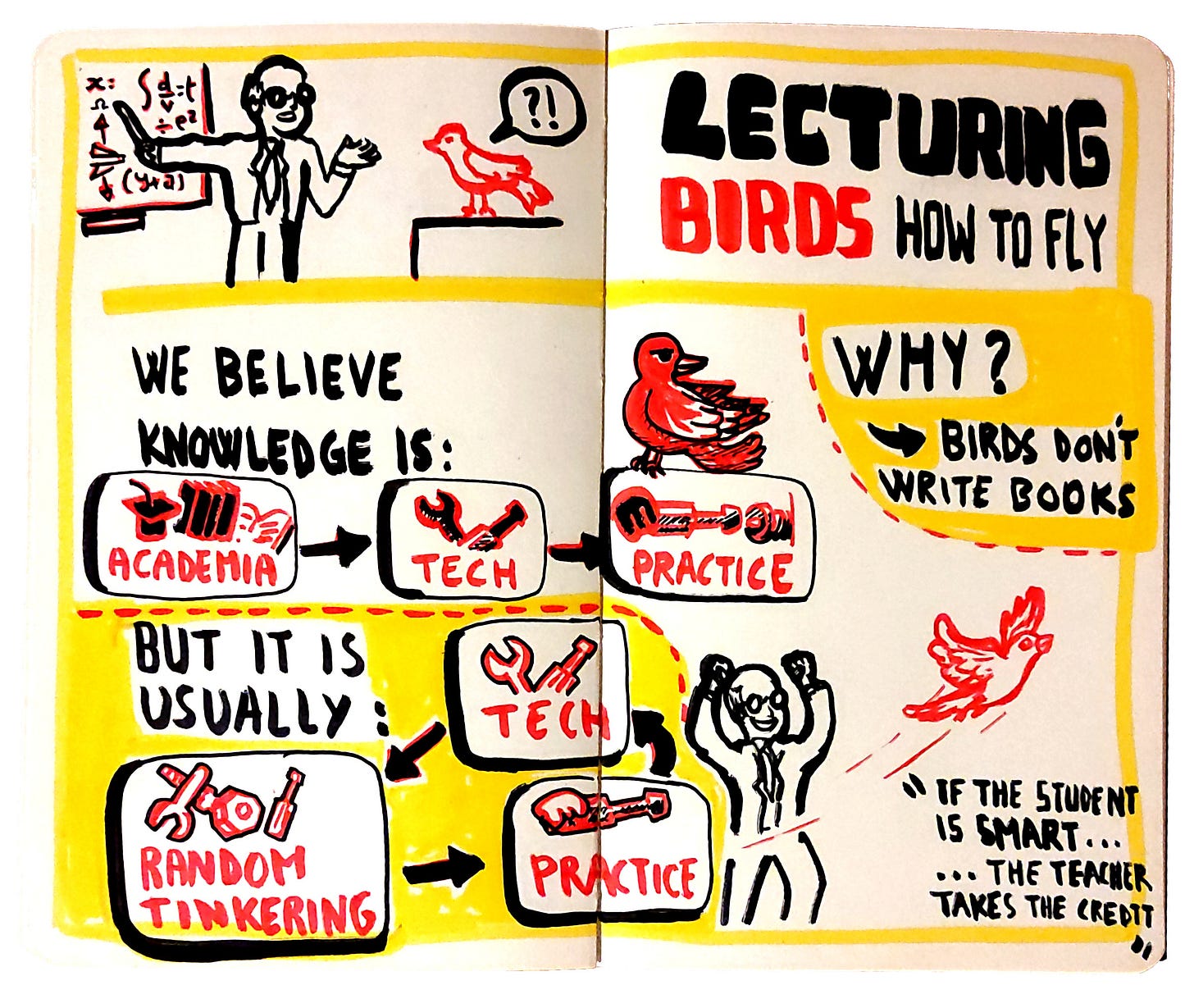

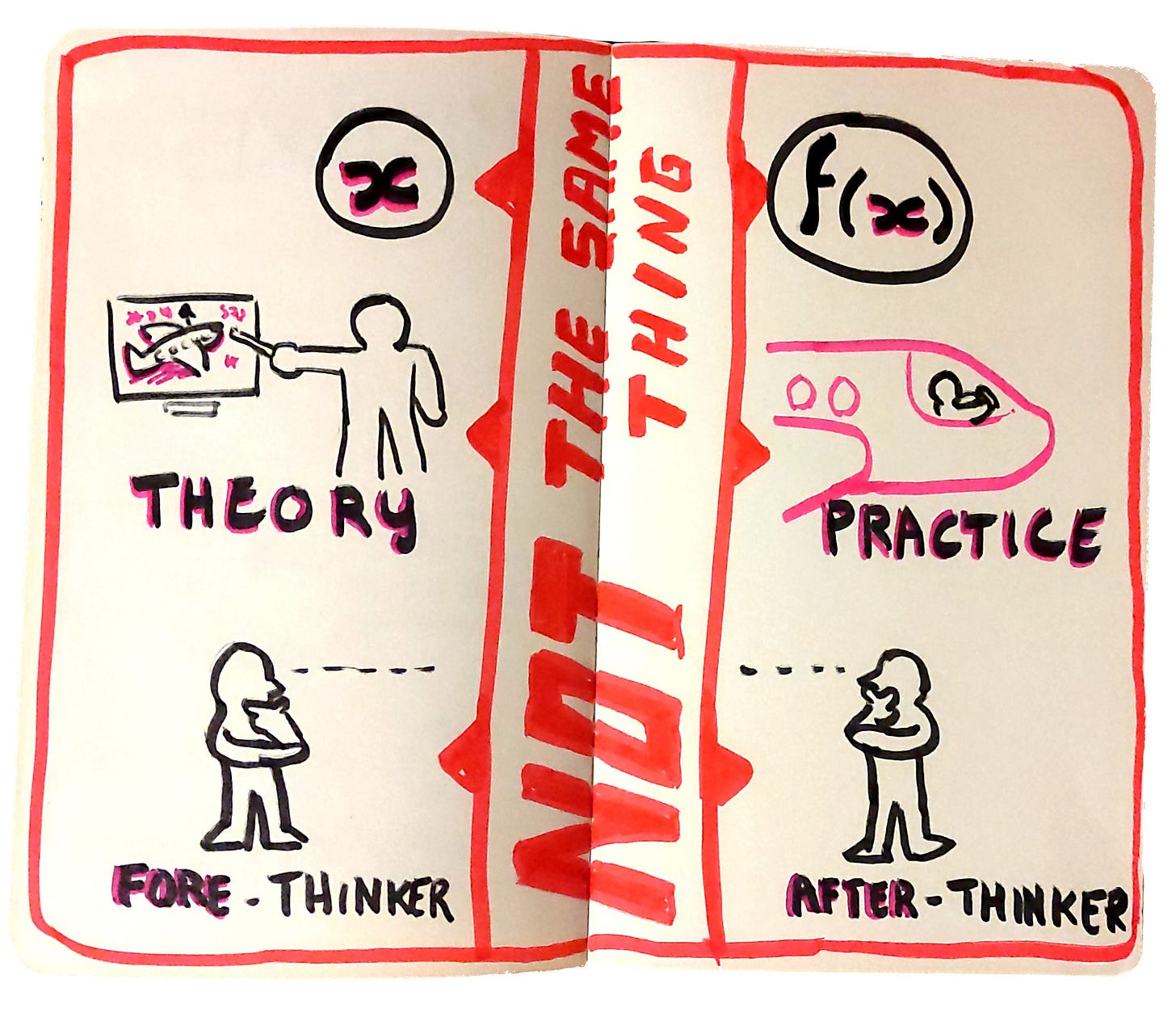

Lecturing Birds how to fly

If most knowledge comes from "Random Tinkering" and practice, why do we usually think that Academia is where everything starts?

… Because birds don't write books.

Birds fly, Tinkerers invents, but people in academia are the ones writing papers and books, reaping most of the credit.

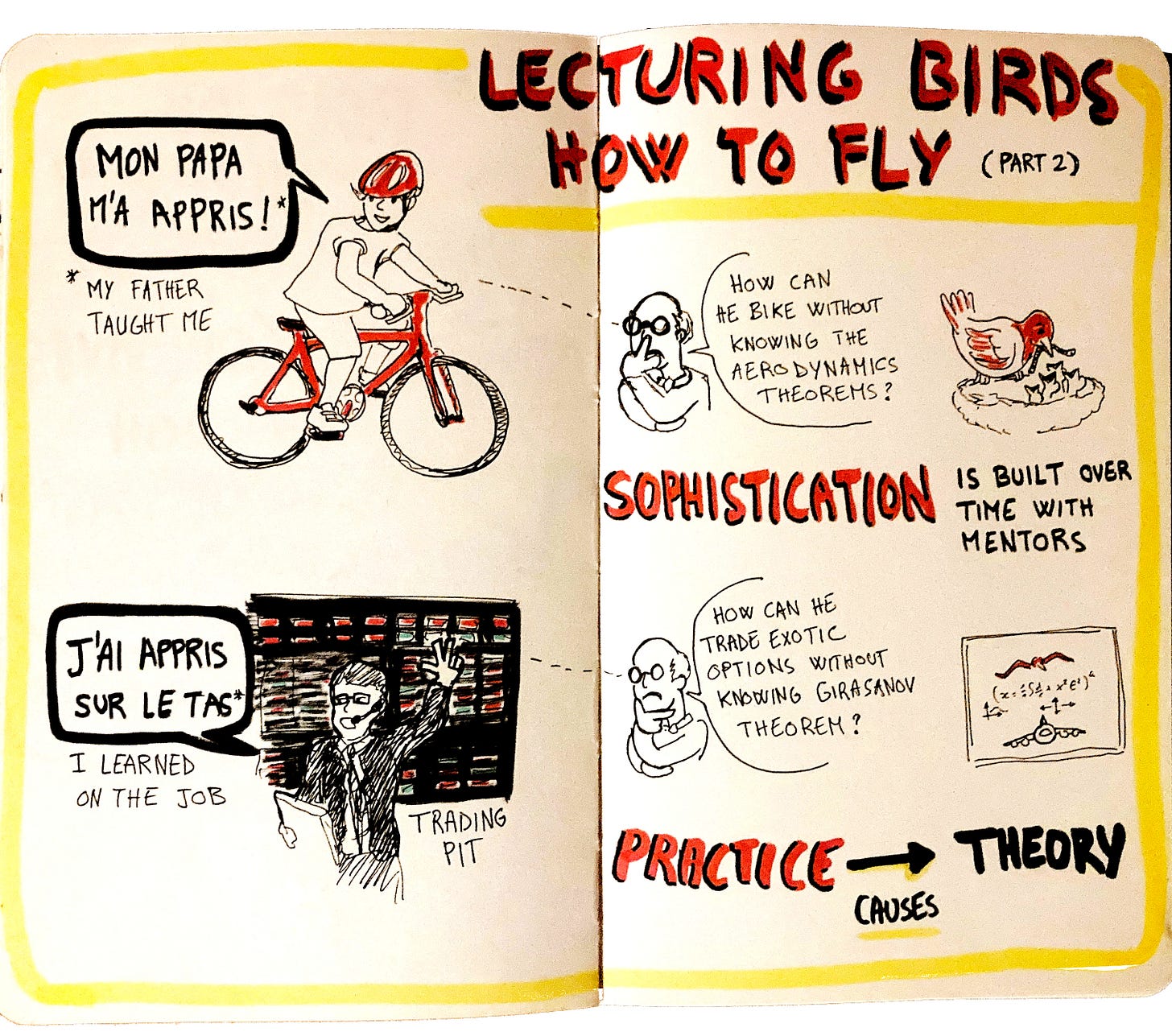

Theory and Academic knowledge is usually created because of an existing practice rather than the opposite,

N.Taleb takes Cathedrals, and even Jet engines as exemple where the mathematical knowledge came later.

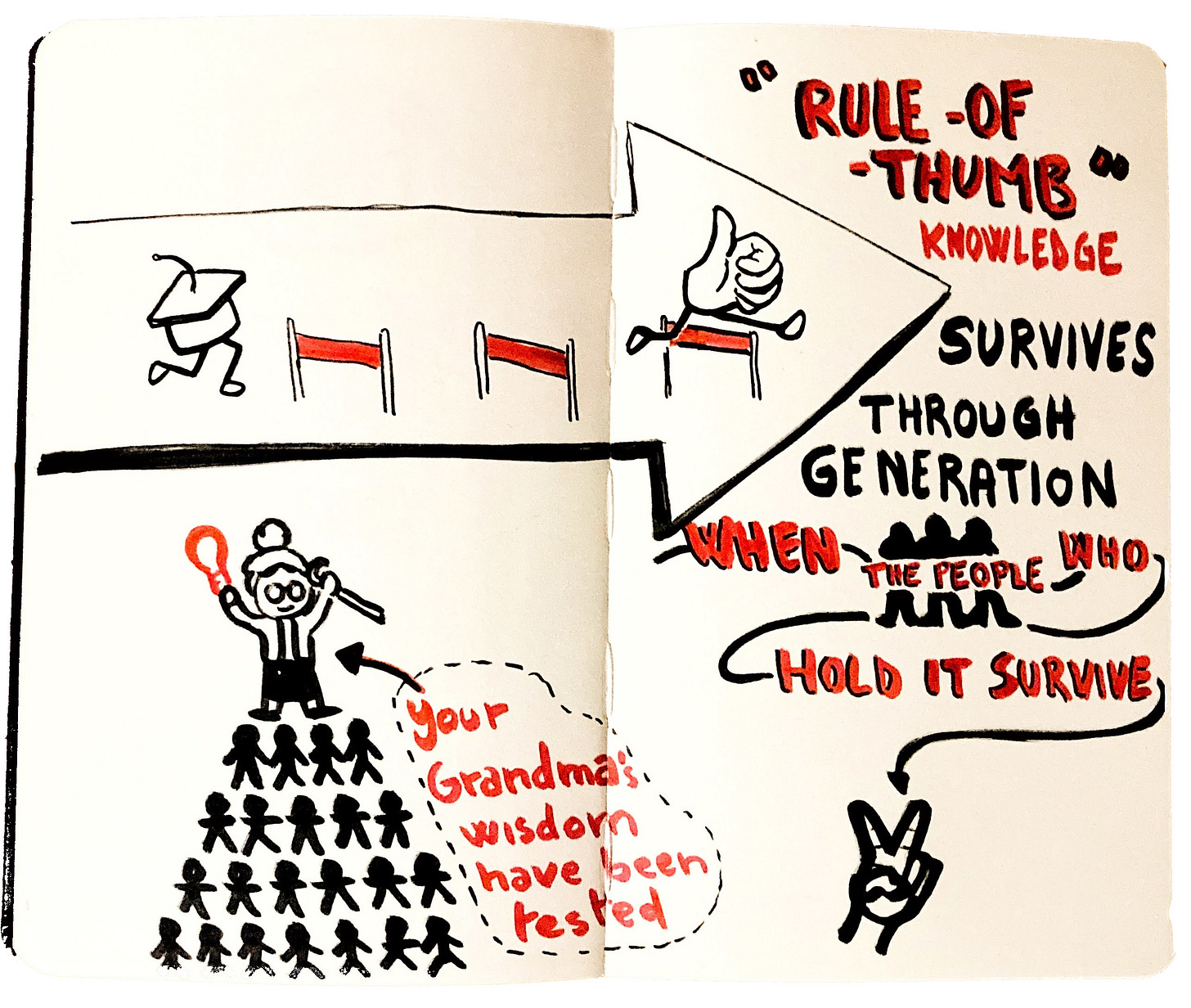

“Rule of thumb” knowledge is valuable as it was able to survive throughout the years.

Or to say it simply: Listen to your grandma!

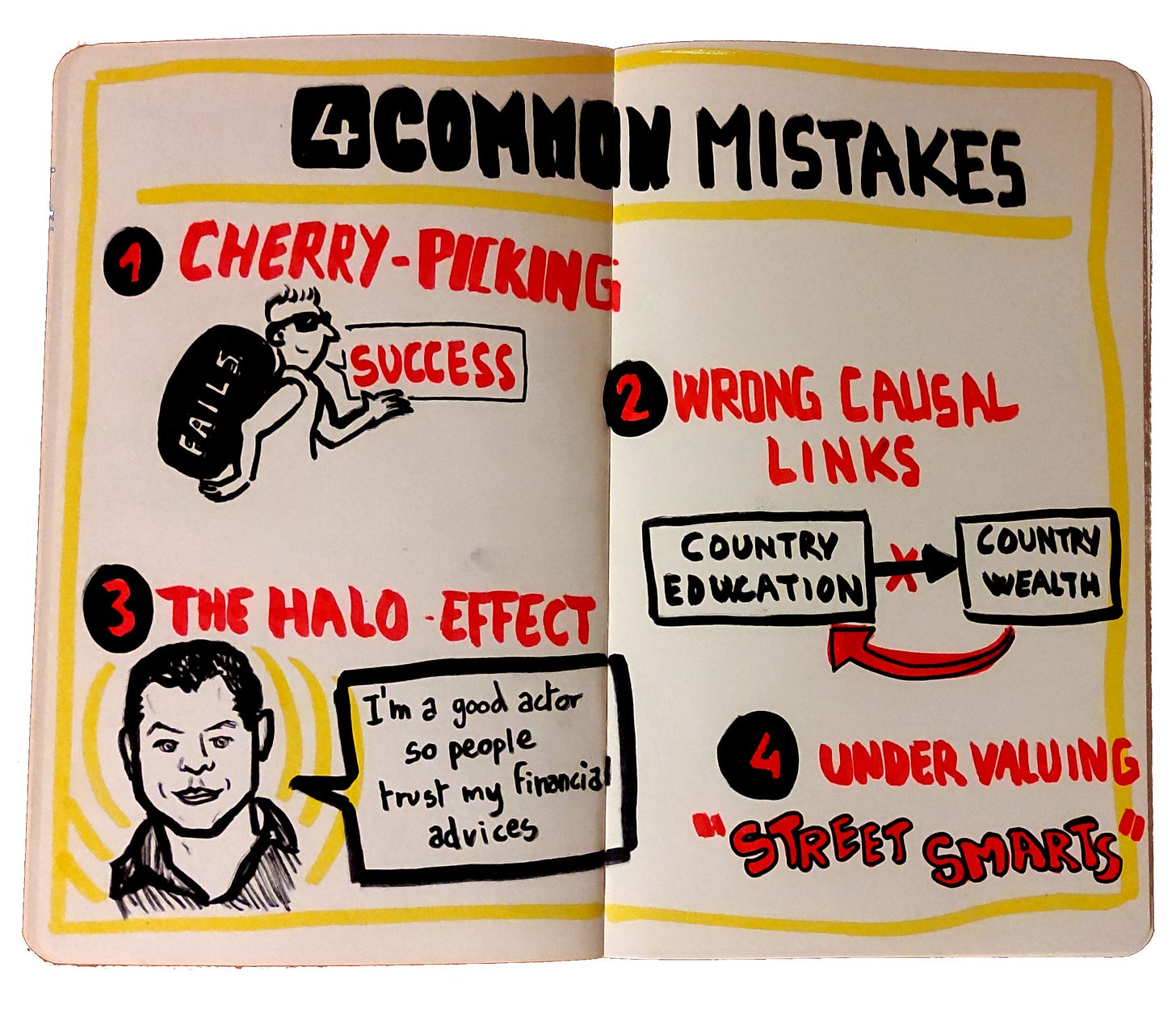

A few mistake to avoids (a bit rephrased):

Cherry-Picking: Only picking the examples that confirm your case and ignoring the one that don't.

Wrong causal links: we look at history and most things backward and have the tendency to assume a cause effect, where there are none or even the opposite cause.

In the book the example the author takes is the level of education as the cause to wealth in a country, he present evidence suggesting that, in a lot of countries, the wealth came first.

The Halo effect: Assuming that somebody competent in one field or at one skill would be good at another. Example: somebody good at "speaking" might not be at "doing"

Undervaluing Street Smarts: I added this one as a simplification of the "Green Lumber fallacy", a trader of green Lumber may be good at his job even not knowing what green lumber actually is, he would have a different, more hidden knowledge that makes him successful.

(PS: Green lumber = Wet Lumber)

Summarizing the above, Theory and Practice are “not the same thing”.

Collaboration and Serendipity

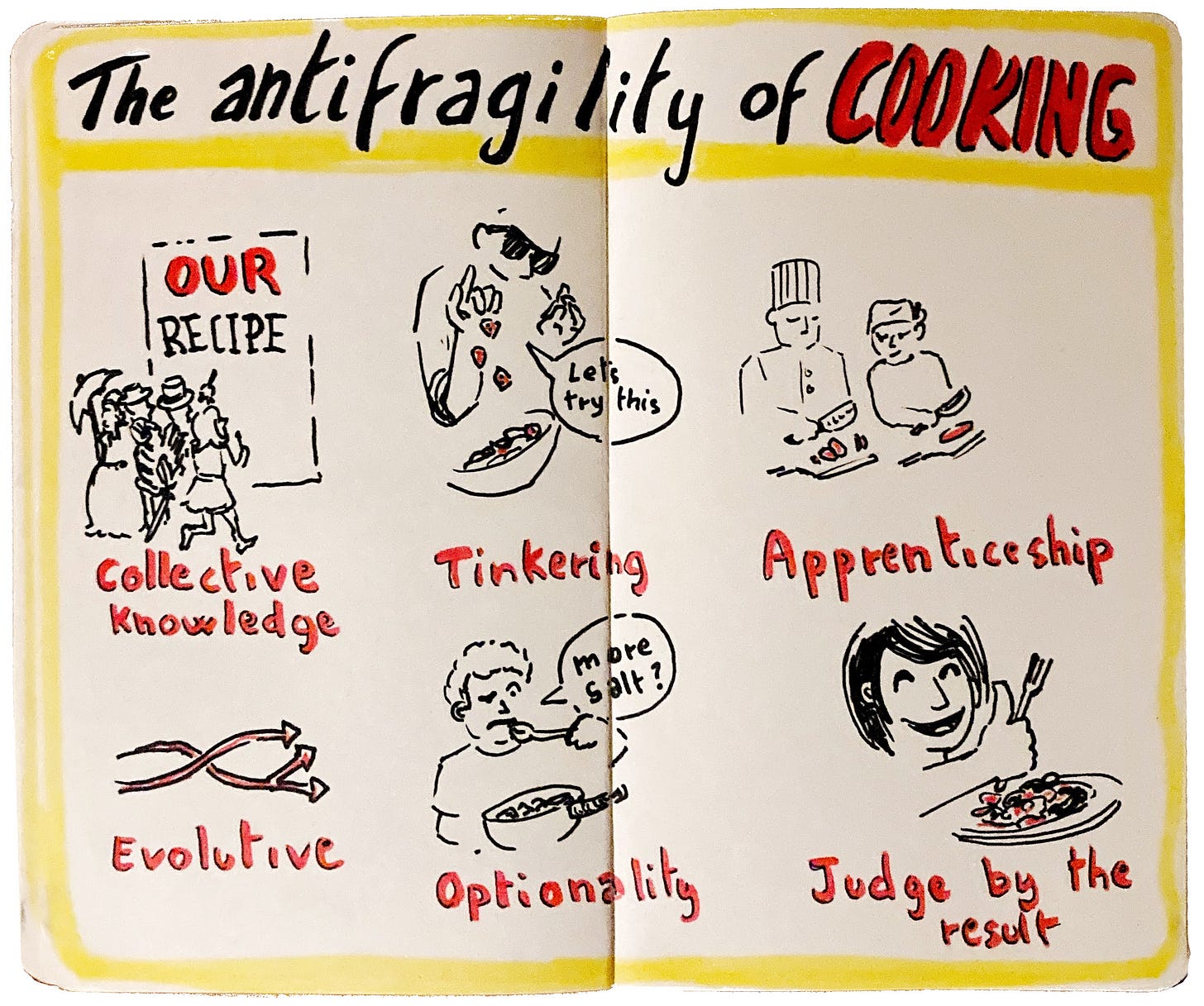

A good example of Antifragility: Recipe!

A good recipe can be passed down, generation after generation, evolving through Tinkering and discovery.

We learn them not by understanding the theory only, but trying to cook it, adapt it to our taste and enjoying the result!

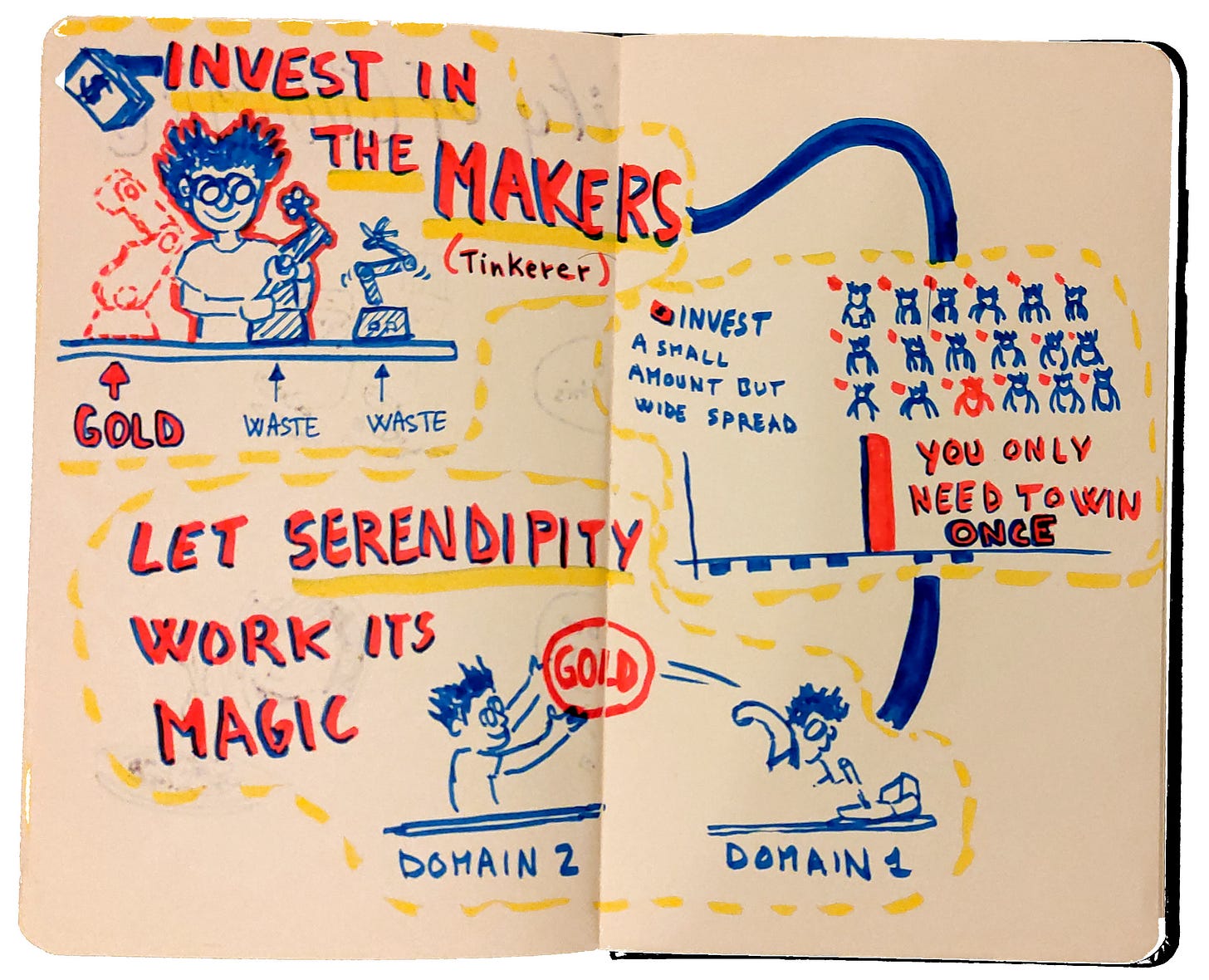

An advice from the book for Government funding:

Invest in the makers!

Following the assymetry concept, making lots of small investments (low downside), with just one win making it worthwhile (high potential upside)!

With serendipity, all those new ideas will start to find their best application, making it a positive outcome for everyone.

Skeptics and religious have something in common: not depending too much on human fallible theories,

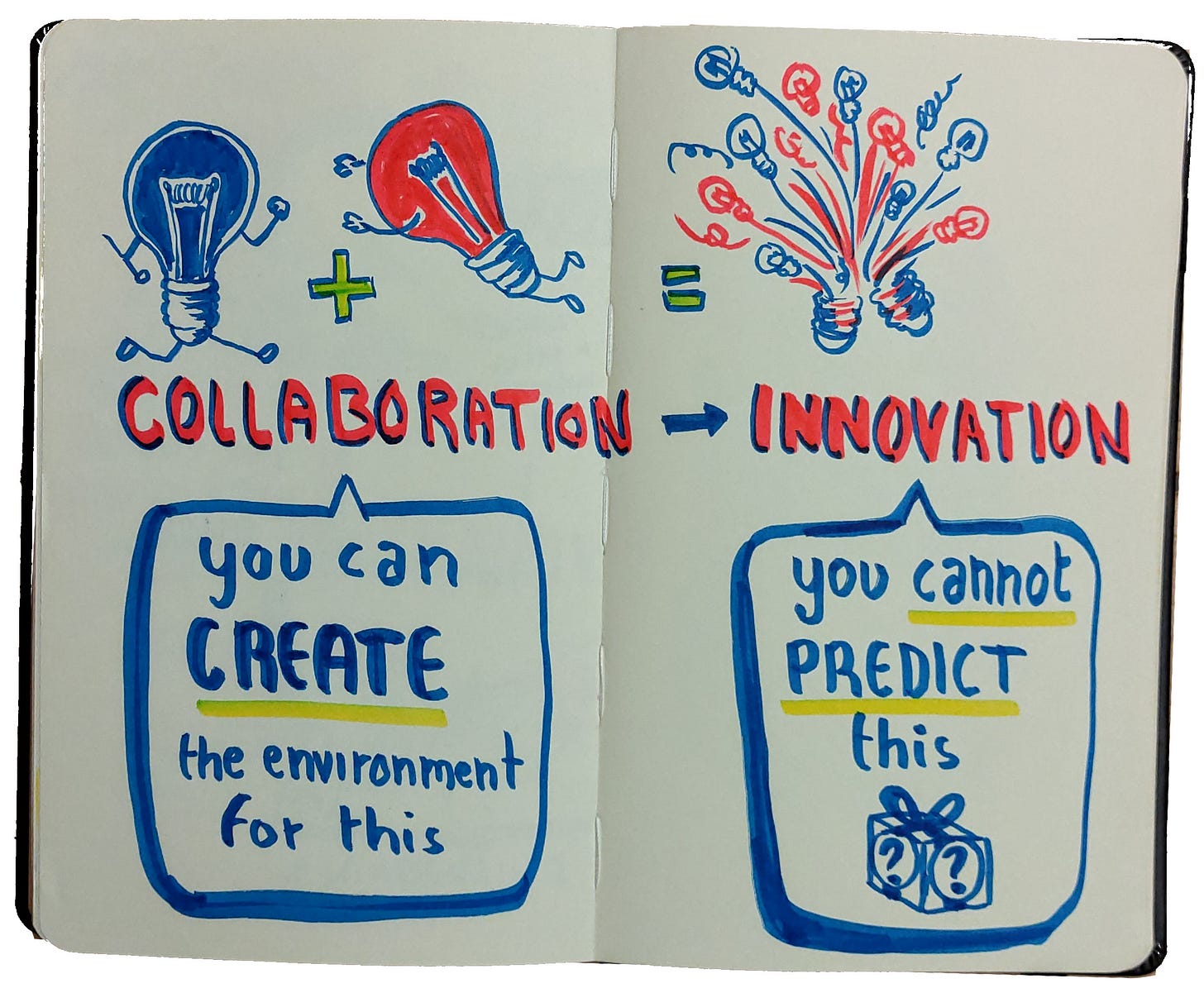

One thing unforeseeable is the results from collaboration and ideas merging, but one thing that can be influenced:

How the environment encourage or discourage collaboration!

Congratulations you completed part 2!

Don’t hesitate to reach out with your comments / advices, and be ready for part 3, a lot of my favorite drawings of the book will be shared there.

Sharing is caring if you enjoy this serie maybe one of your friends / colleagues may too!

You can find the Final Part:

https://open.substack.com/pub/ludtoussaint/p/antifragile-in-60-drawings-final

These are great!

Part 3 is now available here 🙂: https://open.substack.com/pub/ludtoussaint/p/antifragile-in-60-drawings-final